Most people don’t plan to leave their family without clear guidance, yet it happens far more often than many realize. In fact, 76 percent of Americans in 2025 don’t have a will. For families in Nevada, passing away without a will triggers a legal process called intestate succession, which determines who receives your assets, who cares for your children, and how decisions are made on your behalf. Unfortunately, the results often do not reflect what you would have wanted.

This blog explains what happens if you die without a will in Nevada, how intestacy laws work, and why creating an estate plan now offers peace of mind and protection for the people you love most.

What Nevada Intestacy Laws Say About Who Inherits Your Assets

When someone dies without a will, Nevada law decides who receives their property based on their closest legally recognized relatives. These rules exist to create predictability, but they may not match your wishes.

Understanding Nevada’s Default Inheritance Rules

Nevada’s intestacy laws prioritize spouses and children, followed by parents, siblings, and extended relatives (Nev. Rev. Stat. §§ 134.030–134.210). However, the share each receives depends entirely on your family structure. For example, a surviving spouse who shares children with you may inherit differently than a spouse in a blended family.

How Community Property Works in Nevada

Nevada is a community property state, meaning anything earned or acquired during marriage is generally owned equally by both spouses. Separate property, such as assets owned before marriage or inherited individually, is treated differently under intestacy laws. Without a will or trust, dividing community and separate property can quickly become complex for grieving families.

What Happens to Your Children if You Die Without a Will in Nevada?

For parents, the most important question is often what happens to their children if they pass away unexpectedly.

Guardianship Decisions Without a Will

Without a will naming a guardian, the court (not your family) decides who will care for your minor children. While judges try to prioritize stability and the child’s best interests, family members may disagree about who should step into this role. The process can be lengthy and emotionally draining.

Financial Protections for Minors

Children cannot directly inherit assets. Without a will or trust in place, a judge may need to appoint a guardian of the estate or a conservator to manage the child’s inheritance until adulthood. This adds layers of cost, oversight, and restrictions that a simple estate plan could prevent. eep the focus on your child’s stability.

What Happens to Your Property, Home, and Debts Without a Will?

A will does more than direct where your assets go, it helps your family avoid confusion and conflict.

Your Home and Personal Property

In Nevada, surviving spouses generally inherit community property automatically. But separate property is divided based on state law, which may leave fewer assets for a spouse than expected. Real estate may also have to go through probate unless it is owned by a trust.

How Nevada Handles Debts and Liabilities

Your estate pays debts before anything is distributed to heirs. Creditors must be notified, and the court must approve how debts are handled. This can significantly delay the inheritance process.

Protect what matters most.

How Probate Works in a Nevada Estate Without a Will

Without a will, probate is almost always required.

The Role of the Court-Appointed Personal Representative

In the absence of a named executor, the court appoints someone, often a spouse or adult child, to manage the estate. If multiple people want the role, disputes may arise.

Why Probate May Take Longer Without a Will

Probate involves court hearings, document verification, creditor notifications, and asset distribution. Without your written instructions, the court must intervene more often, which can extend the process from months to years.

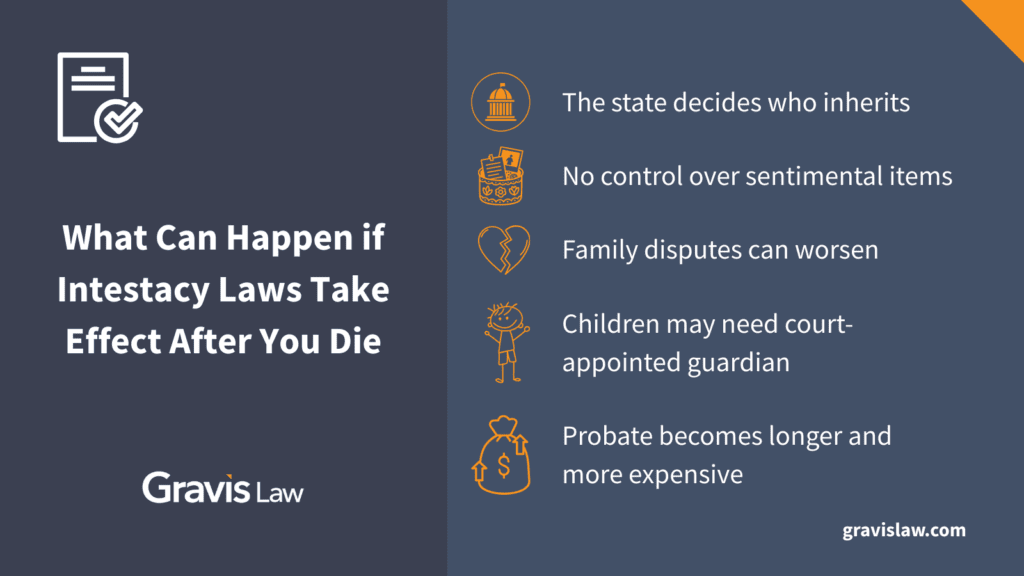

Avoid These Common Pitfalls of Dying Without a Will in Nevada

Assuming Your Family “Just Knows What You Want”

Verbal wishes hold no legal power. Without instructions, your assets follow Nevada law, not your personal preferences.

Leaving Loved Ones with Stress and Uncertainty

Families often struggle when they don’t know your intentions. A simple estate plan can eliminate questions, reduce conflict, and protect your loved ones from unnecessary hardship.

A Nevada Estate Plan Protects Your Loved Ones. Here’s How Gravis Law Can Help

Passing away without a will leaves your family with decisions you never meant them to face alone. A customized Nevada estate plan ensures your wishes are honored, your children are protected, and your assets are handled exactly as you intended.

If you’re ready to avoid the risks of intestacy and build a plan that gives you peace of mind, reach out to us today to schedule a consultation with our Reno-based team.

This article is for informational purposes only and is not legal advice. Your circumstances are unique, and an attorney can provide guidance that fits your needs.

Download our guides for expert insights to plan your estate, navigate family law, or secure your future. Simplify the process with clear, actionable steps. Get started today!