When couples plan their future, they usually focus on finances, shared goals, and long-term security. But fewer couples consider how their will, trust, and prenup or postnup should work together, and how failing to coordinate them can create gaps, confusion, or even conflict later on. These three documents form the foundation of your legal and financial life as a couple. Understanding how divorce impacts your estate plan is crucial to ensuring that your assets and wishes are respected. When they align, they offer clarity, protection, and peace of mind. When they don’t, your assets and wishes may not be honored in the way you intend.

This guide explains how these documents connect, why they matter, and how proper coordination can protect your partnership and your family’s future.

Why Your Will, Trust, and Prenup Need to Work Together

Your will, trust, and prenup or postnup each serve a different purpose, yet all three shape your long-term security. Understanding how they overlap helps prevent future conflicts and ensures your wishes are followed.

Each Document Has a Different Legal Purpose

- A prenup or postnup outlines your financial rights and obligations as a couple, including what’s considered separate or marital property.

- A will directs how your assets pass after death and names guardians and personal representatives.

- A trust manages and distributes assets during your life and after your passing, offering privacy and probate protection.

Conflicts Happen When Documents Aren’t Aligned

Even well-written documents can contradict each other if they’re not reviewed together. A prenup may promise certain property rights that a will does not reflect. A trust may divide assets differently than the prenup outlines. Coordinating everything upfront prevents confusion, disputes, and costly probate challenges.

How Prenups and Postnups Affect Inheritance and Estate Planning

According to a survey by Harris Interactive, 36 percent of adults now view prenups as a smart financial decision. In 2002, only 28 percent shared that opinion. (USA Today Says Prenups are “In” – Pollock Begg)

What Prenups Can (and Cannot) Decide About Inheritance

Prenups can:

- Waive or outline inheritance rights

- Define separate vs. marital property

- Determine financial responsibilities during marriage

See, for example, the Uniform Premarital and Marital Agreements Act (UPMAA), which permits spouses to waive inheritance rights, classify property as separate or marital, and allocate financial responsibilities during marriage.

However, they cannot decide child custody or child support issues.

Why Married Couples Should Still Create a Will and Trust

Prenups outline expectations—but wills and trusts enforce those expectations after death.

Trusts can also:

- Protect children from prior relationships

- Reduce family conflict

- Avoid probate for major assets

For blended families, trusts often provide the clarity and security prenups alone cannot offer.

Estate planning is more than paperwork, it’s a roadmap for your partnership and your legacy. If you want to ensure your will, trust, and prenup work together seamlessly, our attorneys can help.

What Happens to Your Property, Home, and Debts Without a Will?

A will does more than direct where your assets go, it helps your family avoid confusion and conflict.

Your Home and Personal Property

In Nevada, surviving spouses generally inherit community property automatically. But separate property is divided based on state law, which may leave fewer assets for a spouse than expected. Real estate may also have to go through probate unless it is owned by a trust.

How Nevada Handles Debts and Liabilities

Your estate pays debts before anything is distributed to heirs. Creditors must be notified, and the court must approve how debts are handled. This can significantly delay the inheritance process.

Protect what matters most.

Estate Planning for Married Couples: How to Coordinate All Three Documents

Whether you’re newly married, updating your estate plan, or navigating a blended family, coordination matters.

Updating Your Estate Plan After Signing a Prenup or Postnup

Your legal documents should all define separate and marital property the same way. If one document conflicts with another, courts may have to interpret your intentions—often with results you didn’t plan for.

After signing a prenup or postnup, review your:

- Will

- Trust

- Beneficiary designations

- Powers of attorney

- Retirement account instructions

Using Trusts to Support Both Spouses and Children from Prior Relationships

Trusts are powerful tools for blended families. They can ensure:

- A surviving spouse has financial support

- Children from a previous relationship receive their intended inheritance

- Family conflict is minimized

Your assets stay private and protected

Common Mistakes Couples Make When Documents Aren’t Coordinated

Relying Only on a Prenup Without Completing the Estate Plan

A prenup cannot distribute your assets after death. If you don’t create a will or trust, state law (not your agreement) determines who inherits your property.

Forgetting to Update Documents After Major Life Events

Marriage, home purchases, new children, and changes in financial circumstances all require updates. Without revising your estate plan, partners and children may be left unprotected.

Building a Strong Legacy Together: How Gravis Law Can Help

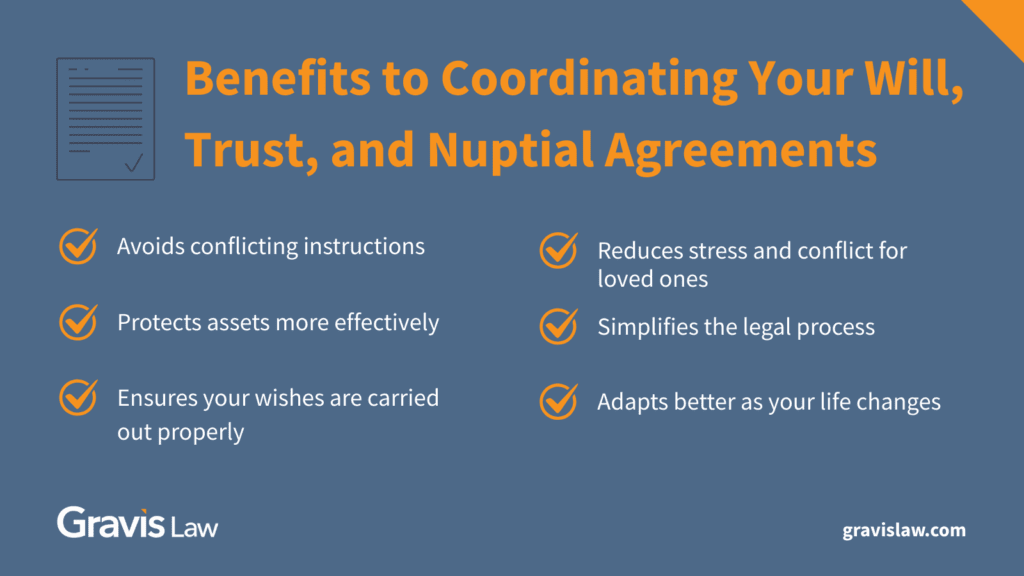

Your estate plan should reflect the life you’re building together, not outdated documents or guesswork. Coordinating your will, trust, and prenup ensures your wishes are honored, your assets are protected, and your family is supported.

If you’re ready to protect your future and bring all your planning documents into alignment, reach out to us today to schedule a consultation.

This article is for informational purposes only and is not legal advice. Your circumstances are unique, and an attorney can provide guidance that fits your needs.

Download our guides for expert insights to plan your estate, navigate family law, or secure your future. Simplify the process with clear, actionable steps. Get started today!