Estate planning is not a one-and-done task. As your life evolves, your estate plan should evolve with you. Whether you’ve experienced a major milestone or simply haven’t reviewed your documents in years, the plan you once created may no longer protect you the way you expect.

Despite its importance, 43 percent of Americans report not having a will or estate planning documents simply because they haven’t gotten around to it. Even among those who do, many assume nothing needs to change once the paperwork is signed. But outdated instructions can lead to confusion, delayed inheritance, or legal results that don’t align with your current wishes.

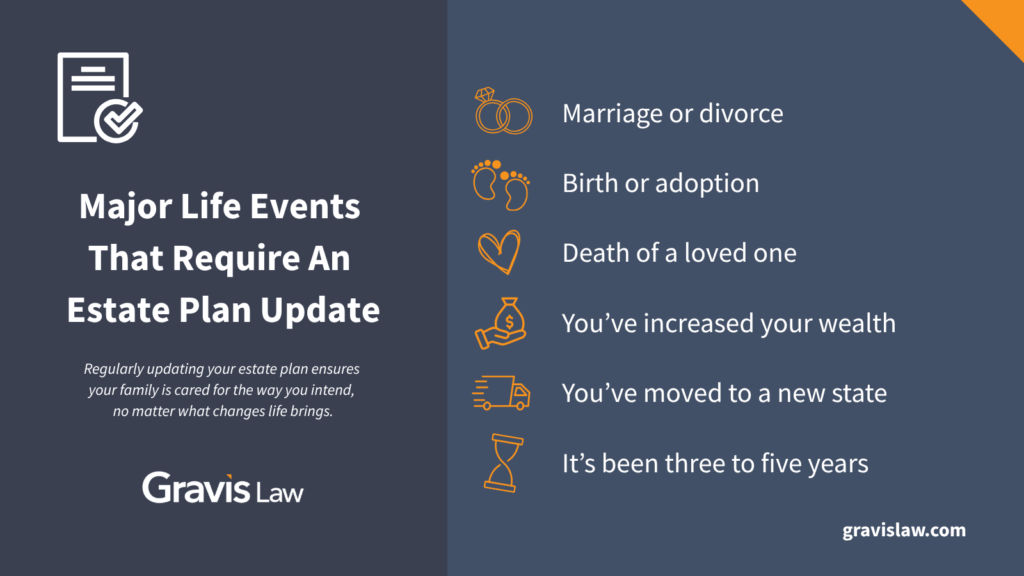

Below, we explain the most common signs it’s time to update your estate plan so your protections and intentions remain current.

When to Update Your Will After Major Life Events

Your life changes, and your will should too. Marriage, divorce, births, adoptions, or the death of a loved one can shift family dynamics and your priorities. These moments often require updates to who receives your property, who cares for your children, and who can make decisions for you if you are unable to do so.

If your family structure has changed in any way, your wills and trusts should reflect your present reality.

1. Your Beneficiaries Have Changed

Beneficiary designations on retirement accounts, life insurance policies, and bank accounts do not automatically update when your will does. It’s possible to unintentionally leave assets to an ex-spouse or someone who is no longer part of your life.

This creates major problems later. Only 46 percent of will executors were aware a will even existed, which shows how crucial clarity and consistency are for the people managing your estate after you’re gone.

Regularly reviewing beneficiaries ensures the right individuals receive what you intended.

2. You Bought or Sold Major Assets

Big financial changes require updated instructions. A new home, business, or investment should be added to your plan. If you’ve sold an asset that’s still listed, removing it prevents confusion and legal issues later.

If your financial situation looks different today than when your estate plan was created, it’s time to connect with an estate planning attorney to update your documents.

3. Your Healthcare and Financial Wishes Have Evolved

Who would make medical or financial decisions for you if you could not? Relationships change and health needs shift over time. The people you trusted years ago may not be the ones you would choose today. Reviewing and updating your:

- Healthcare Power of Attorney

- Financial Power of Attorney

- Advance directive

ensures the right individuals are authorized to take action if needed. A periodic review helps your instructions stay aligned with your current values and preferences.

4. Laws Have Changed: Protect Yourself from Outdated Documents

Tax laws and estate laws aren’t static. Changes in federal or state regulations can affect how your estate is handled. If you moved to a new state, this is especially important, because estate laws differ greatly state-to-state.

Outdated documents risk becoming partially or fully unenforceable. An attorney can ensure your plan remains compliant, efficient, and sound.

Not Sure if Your Estate Plan Still Works?

5. It’s Been More Than Five Years

Even without major life changes, time alone is a reason to review. A general rule is to revisit your estate plan every three to five years. This helps catch smaller changes that still matter, like updating executors, account titles, or charitable gifts.

Treat your plan as a living document that grows with you.

How Gravis Law Helps Keep Your Documents Current

An attorney doesn’t just update your will. They take a comprehensive look at your entire estate picture. This includes asset alignment, beneficiary coordination, guardianship planning, and strategies to reduce the chance of disputes or court involvement later.

With our professional guidance, your estate plan can remain clear, enforceable, and tailored to your goals through every stage of life.

Call Gravis Law Today

Your estate plan should reflect the life you have today, not the life you had years ago. Updating your documents ensures your loved ones are supported, your instructions are followed, and your legacy is secure.

Our legal team is here to help you review and update your plan with confidence. Reach out to us today to schedule a consultation and make sure your estate plan truly protects what matters most.

Download our guides for expert insights to plan your estate, navigate family law, or secure your future. Simplify the process with clear, actionable steps. Get started today!